The HV$ shopping cart is currently under maintenance. Please contact our office at 1-847-487-8258 if you experience issues when attempting to purchase products or services. We apologize for any inconvenience this may cause.

HeliValue$, Inc. held its fourth quarter Blue Book pricing review on January 8, 2018. Resale pricing adjustments were made for the following models:

Bell 206B III

Airbus AS-332L1

Leonardo AW109E, AW119 Koala, AW119 Kx

MD 900/902

Sikorsky S92A

Resale pricing adjustments are based on actual sales transactions and current market conditions such as overall trends in asking prices, increase or decrease in supply, demand, and sales volume. We obtain sales pricing data from owners and operators, lenders and lessors, brokers and equipment manufacturers worldwide.

While we do review all models each quarter, frequently traded models are updated as soon as they begin to show variation from the previously published values. Stay up-to-date on resale pricing changes by purchasing an annual subscription.

Login or Subscribe Now (http://www.helivalues.com/)

Market Comments

After our fourth quarter meeting on January 8, our acting president, Jason Kmiecik and chairman, Sharon Desfor attended Helicopter Investor in London. As always, it was a valuable opportunity to meet up with many of the of financial institutions, companies, operators, and individuals involved in helicopter finance. The conference showcases the pressing issues and questions facing the current helicopter market, and this year was certainly no exception. For a list of the many interesting and informative topics covered at this year's conference, you can see the full agenda here. It also turned out to be the most well-attended Helicopter Investor since its first stand-alone event in 2013.

After our fourth quarter meeting on January 8, our acting president, Jason Kmiecik and chairman, Sharon Desfor attended Helicopter Investor in London. As always, it was a valuable opportunity to meet up with many of the of financial institutions, companies, operators, and individuals involved in helicopter finance. The conference showcases the pressing issues and questions facing the current helicopter market, and this year was certainly no exception. For a list of the many interesting and informative topics covered at this year's conference, you can see the full agenda here. It also turned out to be the most well-attended Helicopter Investor since its first stand-alone event in 2013.

Through various panel discussions and conversations with other attendees, it became evident that the finance and lease communities have mostly come to terms with the lasting recession in the oil and gas industry which has heavily impacted the demand and values of offshore equipment. There were interesting discussions about the mixed opinions of the introduction of the super medium class of aircraft to the offshore market. Other interesting topics included shifts in various market segments, especially EMS, and the dominance of leasing as an option over purchasing and its impact on today's market. All subjects which will be discussed in greater detail in our article to be released during HeliExpo.

The increased popularity of leasing continues to affect resale market activity. More people leasing means fewer people buying. However, light and medium aircraft tend to show more market stability because they are not as heavily impacted by leasing activity and oil prices. Generally, the resale market continues to be weak mainly due to the unusually high supply of aircraft on the market.

Future of the Offshore Heavy Market

Oil prices are slowly on the rise, but supply still remains higher than demand and values continue to decline. The face of the offshore heavy market has begun to shift.

While there are many heavy class models in various roles, the predominantly offshore AS332L2, EC225LP/H225, and the S-92A have generated the most questions about the current state and future of the heavy class of helicopters. These aircraft have been impacted by multiple factors; a transition in the market from new purchase or resale to one largely influenced by the leasing sector, over purchasing of these aircraft by the lessors and operators during the boom of oil and gas, the slump in oil prices that has significantly decreased demand, and of course, the plight of the EC225 after its grounding and subsequent rejection by union oil workers.

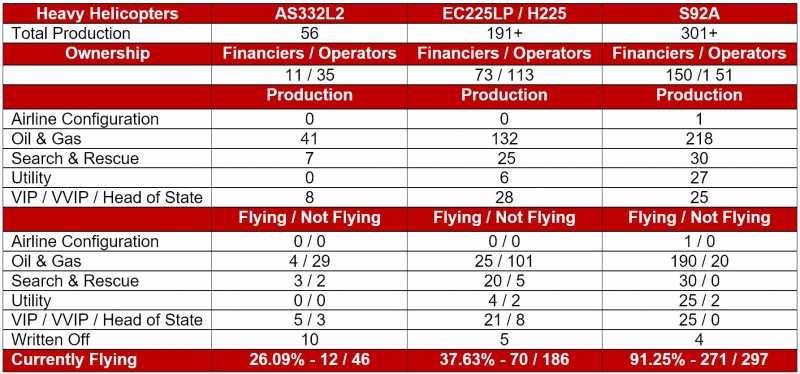

Although the S92A has fulfilled many of the obligations created by the absence of the AS332L2 and EC225, there continues to be an excess of S92As which remain idle or in storage due to a lack of contracts. The chart below illustrates that there are 172 of these aircraft currently in abeyance. This number of aircraft would not be easily absorbed in today’s market or even in the long term.

Current Estimated Operational Breakdown

As a result of this oversupply, there has been a transition of these machines from their primary market into secondary markets. There has been some restored optimism for the EC225LP. The aircraft is finding renewed interest in the utility, para-public (search & rescue, law enforcement, firefighting), and military markets. Utility operators that hadn’t previously entertained using EC225 for their operations are now considering adding these aircraft to their fleet. It has been purported by some in the industry that activity for the EC225 will continue to increase as witnessed over the past six months. This is made evident by recent transactions and conjecture that there are several others pending. Additionally, there has been interest in converting the offshore S92A into a Search & Rescue role. Lessors have been acting on these interests and forming plans for placement of their aircraft. However, both aircraft are suffering from a shortage of parts to perform the necessary modifications. The unavailability of parts has resulted in extensive lead time for conversions to be completed.

Introduction of the Super Medium

The introduction of the 7/8-ton super medium class of helicopters poses a challenge to all heavy class helicopters. The super medium class of helicopters includes the Airbus EC175, Leonardo AW189, and the anticipated Bell 525 helicopter. These aircraft are capable of seating 16 to 18 passengers and perform the same work roles as those in the heavy class. It has been indicated by some that the super medium class of helicopters is capable of performing 90% to 95% of the offshore missions currently flown by heavy class helicopters.

Lessors have a large investment into the heavy class of helicopters, particularly the S92A. Based on current supply and lease rates, it can be more economical to lease an S92A over purchasing a new super medium. It is likely that leasing companies will offer and promote the heavies over the super mediums as the lower cost alternative. Ultimately, the demand of the operators and oil companies dictate the market. If operators/oil companies choose super mediums over the S92A, leasing companies would try to meet that demand and there would be an increase in the number of S92As on the resale market further impacting values. However, the S92A cannot be completely replaced by super medium class aircraft. The S92A would still have a significant market share of the offshore and search and rescue sectors.

Fleet Diversity

Some operators and oil companies have started to ask themselves if they may be too heavily dependent on a single model. Should a massive, long-term grounding like the EC225LP effect the S92A, the shortage would be devastating to operations. Diversifying a fleet with a mix of super mediums and S92As could lower some of the risks should such an event occur. The idea of diversifying a fleet is further spurred by sustained low oil prices which have caused long-range exploration to drastically decrease. Aircraft with a longer range will be in less demand until there is an increased need for long-range exploration.

Impact of Leasing

The helicopter industry has experienced a boom in leasing activity similar to the commercial airline industry, only over a much shorter period of time. Before the entry of the only dedicated helicopter lessor, Milestone in 2010, leasing activity was mostly between operators and on a much smaller scale. Presently, there are six major helicopter lessors with combined fleets of 600+ helicopters worth an estimated seven billion dollars, a large percentage of which are comprised of heavy class helicopters. Since a majority of heavy class helicopters are now owned by leasing companies, this means the lessors are essentially controlling the market for these assets. As lease rates drop to move idle inventory, leasing becomes an even more favorable option over buying a helicopter in today’s market. However, if lease rates continue to fall, asking prices and resale values will continue to decline and may not recover for many models.

Exact numbers of heavies currently for sale is difficult to determine. Based on publicly advertised listings, there are only four AS332L2s, fifteen EC225LP/H225s, and nine S92As. Many have chosen to place their aircraft with brokers as off-market listings, which means these numbers are conservative. Additionally, it is expected, over the next 12 to 16 months, an estimated 40-45 S92As will be coming to the end of their lease term. It is uncertain how many of those leases will be renewed. In response to the continued decline in the offshore heavy market, lessors have expanded their business to include light turbines. Lessor will likely put more focus in markets that are showing more stability and growth such as EMS, law enforcement, utility, and firefighting.

Today operating leases remain an attractive alternative to traditional financing for operators looking to retain cash, maintain balance-sheet flexibility, and align lease terms with contract terms. These benefits are all the more important under the current market conditions.

Outlook

The heavy offshore market continues to face many challenges, but the helicopter industry as a whole is resilient. It’s not certain how this market will evolve, but with time, it will adjust. What number of these offshore heavy aircraft find opportunities in different work roles, and what impact the new class of super mediums will have, will determine how that future is defined.

Meet us at HeliExpo 2018 in Las Vegas!

HV$ HeliExpo Meeting Scheduler

Please use the link above if you would like to schedule a meeting or a tour of the Blue Book.

Benjamin Henry Moore Jr., passed away Saturday, Nov. 11, 2017 at the age of 71, after a very short battle with cancer.

Ben was born on June 19, 1946 to the late Benjamin Henry Moore, Sr. and Beth McCallum. Survived by wife, Lindsay, two children: Allyson and Celeste, and eight grandchildren: Joshua, Jeremy, Brittany, Ana, Laura, Moriah, Benjamin, and Elijah.

Ben loved flying helicopters and teaching. Ben began his lifelong interest in helicopters in 1967 when he volunteered for the US Army, spending five years serving as a helicopter pilot, instructor pilot, and operations officer. His military service included a year's tour in Vietnam as a helicopter pilot in 1969. He earned the Distinguished Flying Cross, among other honors. For over 50 years, Ben continued his aviation career as a line pilot, instructor pilot, training pilot, chief pilot, and construction manager with various operators around the world. He flew missions and trained pilots in Ecuador, Peru, Iran and the United States. Spending his past few summer flying for Helicopter Transport Services of Aurora, Ore., as a firefighter pilot, fighting wildfires in Montana.

Flying was not his only passion, Ben appraised helicopters, specializing in heavy-lift aircraft appraisals and inventory appraisals, onsite examinations. He worked beside the staff at HeliValue$, Inc. for over 15 years teaching new appraisers the trade.

As an alternative to flowers, please consider donating a memorial gift in honor of Benjamin Moore to the Disabled American Veterans (DAV).

On Saturday, December 2, our website will be down for maintenance at 10 am CST for approximately 30 min.

Current subscribers will need to set up a new password to gain access to the new website. If you are currently subscribed to The Official Helicopter Blue Book®, please click on the button below. Once you have entered and submitted the email address associated with your account, you will receive an email with a link that will direct you to a page where you will set your password.

If you are not a current subscriber, you may click on the button below to register a new account. New accounts will be required before purchasing subscriptions and appraisals.

If you have any issues logging into the new website, please contact our office by email at info.helivalues.com or by phone at 1-847-487-8258.

HeliValue$, Inc. held its second quarter Blue Book pricing review on June 30, 2017. Resale pricing adjustments were made for the models listed below.

Airbus EC-135P1, EC-135T1, EC-135P2

Bell 412, 412HP, 412SP, 429

Sikorsky S-76B, S-76C, S-76C+, S-76C++

Resale pricing adjustments are based on actual sales transactions and current market conditions such as overall trends in asking prices, increase or decrease in supply, demand, and sales volume. We obtain sales pricing data from owners and operators, lenders and lessors, brokers and equipment manufacturers worldwide.

While we do review all models each quarter, frequently traded models are updated as soon as they begin to show variation from the previously published values. Stay up-to-date on resale pricing changes by purchasing an annual subscription.

Norway and the UK have announced plans to lift the Airbus H225 grounding, however the investigation into the April 2016 crash continues. Unions and most of the supermajor oil companies have stated that they will not consider putting the H225 back into service until the root cause of the incident is determined. Shorter Time Before Overhauls (TBOs) and Time Before Inspections (TBIs) within the main gearbox, and the newly mandated safety presentation to restore the H225 back to flying status may also have an impact any decision to put the aircraft back in service. In the meantime, operators have not found it difficult to fill the gap with other aircraft like the S-92 and the AW-139.

The helicopter industry, in general, continues to do fairly well. An active fire season has helped light single and twin turbine engine models in North America and used corporate configured helicopters have seen an uptick in sales. However, the used helicopter market continues to feel the impact of the recession, the loss of mineral and exploration contracts, and the oil and gas downturn. There has been some overall improvement in the used market mostly due to a decrease in single light inventory levels. Medium and heavy inventory continues to grow especially offshore equipped models. As leasing has become the go to solution in today's market, used resales have dwindled with fewer and fewer transactions taking place each quarter. OEMs, brokers, and consultants are all feeling the effects.

New sales have also been impacted by lessor activity and the prolonged oil and gas downturn. With a shrinking number of available contracts and the lessor's ability to easily fill those contracts with new or lightly used aircraft, potential buyers are finding it more financially beneficial to consider a leasing option over a new purchase from the OEM.

What is becoming more and more obvious is that leasing companies are changing the face of the helicopter resale market. The result is that most new deliveries are going to leasing companies and municipalities rather than operators and the resale market continues to be stagnant.

HeliValue$, Inc. held its first quarter Blue Book pricing review on March 31, 2017. Resale pricing adjustments were made for the models listed below.

Airbus AS-350B2, AS-355N, EC-155B1, AS-365N3

Agusta AW109E, AW109S, AW119K

Bell 206BIII, 206L-3, 206L-4, 407GX

Sikorsky S-76A++, S-76C, S-76C+, S-92A

Resale pricing adjustments are based on actual sales transactions and current market conditions such as overall trends in asking prices, increase or decrease in supply, demand, and sales volume. We obtain sales pricing data from owners and operators, lenders and lessors, brokers and equipment manufacturers worldwide.

While we do review all models each quarter, frequently traded models are updated as soon as they begin to show variation from the previously published values. Stay up-to-date on resale pricing changes by purchasing an annual subscription to The Official Helicopter Blue Book®.

Values improving, declining, and holding steady; when is this roller coaster going to come to the end of its track? The year is starting off with some good news. This quarter, for the first time since 2009, values have increased for a few models. There has also been a notable increase of reported sales transactions in the first quarter. Perhaps buyers are beginning to take advantage of the rock bottom prices for some of the aircraft on the market.

In general, the single turbine market seems to be fairly active right now. Older Airbus AS350B2 and Bell 206L-3 values are improving. On the other hand, the newer Bell 206L-4’s and 407’s are softening. It’s possible that the newer machines are more than operators need at this time with tough competition for contracts and limited work in utility operations.

Light-twins continue to struggle to find a place out there. Values have dropped to record lows as have contracts for them. Mediums, for the most part, are still softening. The Leonardo AW-139, however, is having great success as the go-to helicopter for the offshore industry who has grown to love this model.

Heavies, heavies, heavies; the multi-million dollar topic! While the Airbus EC225LP crash is still under investigation HeliValue$’ has chosen not to publish resale values or provide valuations on this machine or the also affected Airbus AS332L2. Until there is a conclusion of that investigation, there is not a practical way to determine the current market or the anticipated future for these models.

The number of Sikorsky S-92A aircraft on the market is increasing mostly due to a dearth of contract renewals. Unfortunately, some of the contracts that are renewing are now requiring alternative aircraft such as super mediums. Both asking prices and market demand for used S-92A’s has been declining over the past two quarters. Leasing companies have managed to fill most of the contract demands with aircraft returned to them as part of the CHC restructuring process.

There are some bright spots, but the oil market probably has the biggest impact on the helicopter industry as a whole. We will continue to see instability in the market as the industry settles into the new reality of sustained low ppb oil becoming the norm, not just a momentary downturn.

Oil Market Overview & Its Effects on the Sikorsky S-92A

I recently had a conversation with a marketing member of one OEM. We were in agreement that many of us did not see a continuation of low activity for this long. We asked ourselves, "What happened in the last 18 months to cause the continuing excess of heavy helicopter inventory?" Our past reasoning was that oil prices would return as demand would surely increase. In an article published in Forbes on August 28, 2016, Jude Clemente argues that world oil demand will continue to increase. It has steadily increased even through the 2008 recession. So what did we miss?

The Decline of OPECs Pricing Influence

America continues to be the largest consumer of petroleum products with the European Union close behind. China is third but has the fastest growing demand. The United States consumes about 19,400,000 barrels of oil daily, the EU is at about 18,000,000, and China is at about 12,000,000.Everyone else is far behind, but next is India at about 4,200,000. India has the second largest population in the world with an estimated 358,000,000 under the age of 15. Mr. Clemente says this is the biggest reason that India’s economy and thus petroleum product use will continue to rise rapidly in the coming years.

America continues to be the largest consumer of petroleum products with the European Union close behind. China is third but has the fastest growing demand. The United States consumes about 19,400,000 barrels of oil daily, the EU is at about 18,000,000, and China is at about 12,000,000.Everyone else is far behind, but next is India at about 4,200,000. India has the second largest population in the world with an estimated 358,000,000 under the age of 15. Mr. Clemente says this is the biggest reason that India’s economy and thus petroleum product use will continue to rise rapidly in the coming years.

In an article from Fuel Fix, a subsidiary publication of the Houston Chronicle, dated March 2016, Jennifer Hiller points out that the US dependence on foreign oil has declined dramatically. We import about 25% (this figure changes depending on definition and point of view), the lowest point since 1970. We were still importing over 50% until 2011. America’s demand for oil peaked in 2005 at a daily rate of 20,500,000 bbls. We are now using 19,000,000 bbls of oil daily. Most of the EU countries are showing the same trend of peaking some time ago and are now showing lower levels of daily demand. Regardless, that is still a considerable level of petroleum product usage.

In an article from Fuel Fix, a subsidiary publication of the Houston Chronicle, dated March 2016, Jennifer Hiller points out that the US dependence on foreign oil has declined dramatically. We import about 25% (this figure changes depending on definition and point of view), the lowest point since 1970. We were still importing over 50% until 2011. America’s demand for oil peaked in 2005 at a daily rate of 20,500,000 bbls. We are now using 19,000,000 bbls of oil daily. Most of the EU countries are showing the same trend of peaking some time ago and are now showing lower levels of daily demand. Regardless, that is still a considerable level of petroleum product usage.

There are 13 member nations now, and relations between the member nations are very shaky. Indonesia dropped out last year in disagreement with the “core” members. There are 117 countries producing oil today. Out of the top 25 oil producing countries, 16 are non-OPEC member nations.

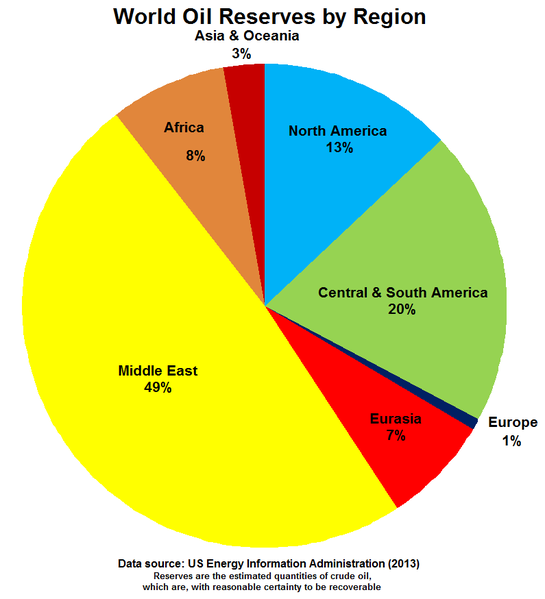

Where are the largest reserves today? Well, it depends on who is reporting the data and what definition of “proven reserves” is being used. There is no doubt that OPEC sits on a significant portion of the World’s oil. North America has surpassed Saudi Arabia, Russia, and Venezuela in estimated reserves. Estimates of China’s reserves seem to go up every year. Russia certainly has a significant amount of oil reserves. A majority of world reserves are now outside OPEC.

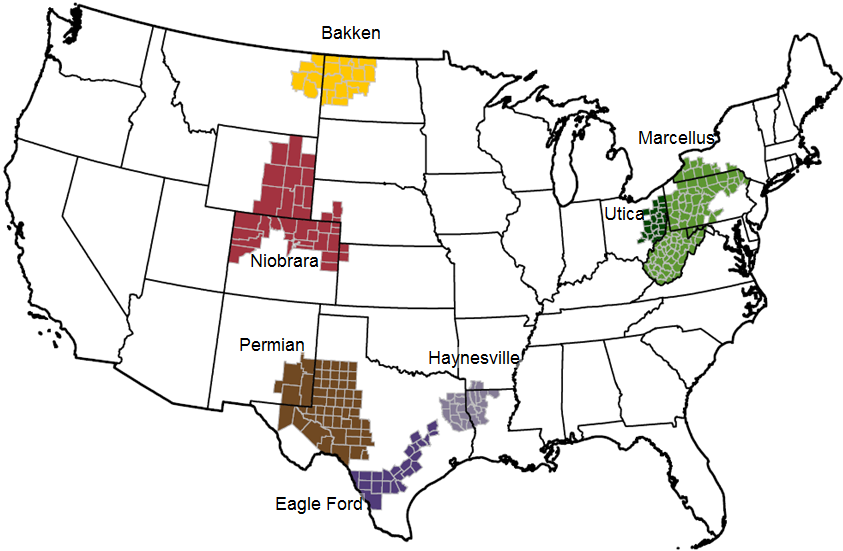

Exploitation of Shale Oil Reserves

The main reason that North America now has such large reserves is the viability of oil recovered by hydraulic fracturing. It was once thought that the price per barrel of oil had to be about $100 to make oil recovered by “fracking” economically viable. That was in 2011. The technology and techniques have improved every year. Oil prices had to be at $70 for fracking to be economical in 2014. In 2016 U.S. Energy Information Administration (EIA) commissioned HIS Global Inc. (HIS) to perform a study of upstream drilling and production costs. The report found that average well drilling and completion costs last year had fallen 25 to 30 percent below 2012 prices – the high point of the last decade.

The main reason that North America now has such large reserves is the viability of oil recovered by hydraulic fracturing. It was once thought that the price per barrel of oil had to be about $100 to make oil recovered by “fracking” economically viable. That was in 2011. The technology and techniques have improved every year. Oil prices had to be at $70 for fracking to be economical in 2014. In 2016 U.S. Energy Information Administration (EIA) commissioned HIS Global Inc. (HIS) to perform a study of upstream drilling and production costs. The report found that average well drilling and completion costs last year had fallen 25 to 30 percent below 2012 prices – the high point of the last decade.

It continues to get cheaper each year. For instance, when the price of oil got to $56 a barrel, many owners of fracked oil wells turned on the spigots, and US demand for imported crude oil dropped. The price for a barrel of crude dropped to $50 and has “recovered” to $51. Oil recovered from “fracking” is termed “tight oil.” Tight oil comes out of the ground cleaner meaning it is cheaper to refine into usable petroleum products than Brent Crude or May West Texas Crude (heretofore, the cleanest recovered oils). Despite the low price of oil, rig counts in the US are increasing.

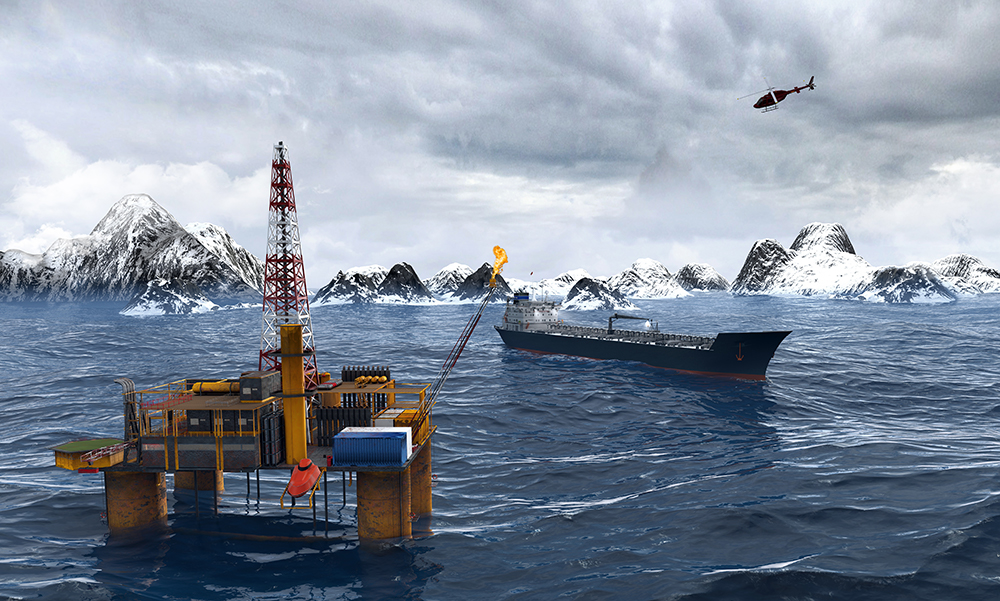

The North Sea reserves are located far offshore and in deep water. Weather rapidly changes and can be very severe. It increases the cost to discover oil and then to recover oil. The Brazilian and Angola reserves are the next highest cost to recover because their reserves lay offshore under a sometimes two-kilometer thick “Presalt” layer. It is true that those costs have gone down as technology and techniques have improved, but any “deep water” exploration and recovery carries a higher cost than shallow water and land recovery oil wells.

The Effect on the Used Sikorsky S-92A Market

There were significant changes to helicopter values during our March 31, 2017, pricing meeting. The aircraft that had the most significant movement was the Sikorsky S-92 A. This is mostly due to the paucity of contracts in the North Sea. Obviously, the plunge in world oil prices in 2014 and the continuing low pricing per barrel of oil are the main reasons for the low helicopter activity. Another factor is the introduction of the “Super Medium” H175 and the AW189 in an already saturated market. The cost savings of leasing, buying, and operating the H175 or AW189 is giving them an edge compared over other heavies. There has also been an increased use of AW-139s where they can be employed over other aircraft. Regardless, any way you look at it, contract activity is very low and some available contracts are now requiring alternatives to the S-92A.

There were significant changes to helicopter values during our March 31, 2017, pricing meeting. The aircraft that had the most significant movement was the Sikorsky S-92 A. This is mostly due to the paucity of contracts in the North Sea. Obviously, the plunge in world oil prices in 2014 and the continuing low pricing per barrel of oil are the main reasons for the low helicopter activity. Another factor is the introduction of the “Super Medium” H175 and the AW189 in an already saturated market. The cost savings of leasing, buying, and operating the H175 or AW189 is giving them an edge compared over other heavies. There has also been an increased use of AW-139s where they can be employed over other aircraft. Regardless, any way you look at it, contract activity is very low and some available contracts are now requiring alternatives to the S-92A.

Because of the distance required to fly to any oil well, the S-92A is used almost exclusively in the North Sea, to a lesser extent the Brazilian Atlantic and the Gulf of Mexico. The older S-92A values are suffering from, well, age. Many of the new contracts in the North Sea will call for newer S-92As because of the requirements of oil companies and/or unions. Renewed production of the S-92A will face stiff competition because some of the contract renewals are asking for mediums and super mediums rather than the S-92A for cost savings. As a consequence, we see some used S-92A’s being returned to the banks at the end of their contracts. With virtually no secondary market for this aircraft, there has been little interest in what is coming onto the market. The trend of decreased values will likely continue until oil prices recover to a level that is profitable in the North Sea or the values of the S-92A reach a level that competes with the Super Mediums.

Oil prices may not have to recover as much as some fear to bring more activity to the North Sea. The big players (ExxonMobile, Shell, BP, Talisman, Hess) need a large profit margin to explore and operate. The smaller players, for example, Wintershall, Delek, and Chyrsaor, do not need a large exploration budget and they are willing to work on a smaller profit margin. They don’t look for oil. They exploit “spent” oil tracts. They don’t need the per barrel price for oil to be as high as the “large” oil companies. Wintershall’s Maria field was drilled the first time in the 1980s by Statoil. Wintershall acquired the rights recently and by combining pipelines and consolidating oil rigs, plan to continue to extract oil profitably. This is the possible future for “played out” oil fields throughout the North Sea. So, about $55-$60 a barrel could bring a return of some new contracts. The Maria field is about 200kms off the Norwegian Coast. Older helicopters would not be a problem as these operators need a tighter margin (read cheaper helicopter rates) to be profitable.

Technological advances will continue to drive down drilling cost on and offshore. As the world settles into the shift of sustained low ppb oil, the adaptive S-92A helicopter market will eventually find it's place in this new era.

About Ben Moore, ASA - Mr. Moore is a staff appraiser with HeliValue$, Inc. He specializes in helicopter parts inventories, legacy, Russian made, and military helicopters. He was a part-time onsite verification representative of HeliValue$, Inc. from 1984 to 2007. He developed the appraisal programs for inventories, the S64 “Aircrane”, the Russian helicopters MI-8 & KA-32-117, the UH-60 and the CH-47D. He is also a part-time Line Pilot in Command for Helicopter Transport Services, Inc.

As an Instructor Pilot, Mr. Moore has accumulated over 8,000 flight hours of instruction. He has given instruction to Vietnamese, Iranian, Ecuadorian, Peruvian and Canadian pilots in both flight and ground instruction. He has taught flight and ground training to Ecuadorian and Peruvian Pilots in Spanish. He teaches a full transition course for both the S-58 and the S-61 helicopters.

About HeliValue$, Inc. - Continuously published since 1979, The Official Helicopter Blue Book® is the only blue book in the world devoted entirely to helicopters. HeliValue$ is Most Trusted World Wide®in the helicopter industry for resale pricing, technical specifications, and maintenance costs. Their only business is helicopter values: the subscription sales of their publications, their desktop appraisals, onsite asset verification, technical and operational analyses, residual projections, and related reports concerning the values of more than 200 different commercial models and their components.

Login

Login