The dangers and uncertainties of an unstable market are plentiful. Businesses struggle to find their footing and make all possible adjustments to survive the storm. We are seeing some recovery, but it’s no secret that the helicopter industry is still trying to cope with a depressed market. We’ve seen almost every possible situation play out during the downturn; from acquiring operational funds through the leveraging of assets, the sell-off of assets, returned leases, bankruptcy and restructuring, and some closing the doors completely. In almost all cases, an appraisal is required and depending on the situation, the parties involved are either looking for the highest possible values or the lowest possible values.

The pressures these businesses are experiencing are often passed along to the appraisal firm. Frequently, this is manifested in the appraisal request itself: requests for certain “types” of appraisals that would be misleading in a given set of circumstances, requests for a guarantee of a clients’ pre-determined opinion of value, changes in the definition of a type of value, approaching an appraisal assignment for a purpose for which it will not actually be used, etc.. An appraisal performed for the clients’ desired outcome rather than actual market conditions and for the proper purpose is not only misleading to any end user and takes away any real value in the appraisal, but it is also unethicaland comes with sometimes serious consequences.

Most notably, it is the inflated values that will cause the greatest damage down the road. Not only can inflated values skew an entire market segment, they can leave investors and lenders holding debt backed by assets that are worth much less than they think. We’ve repeatedly seen, over the history of the helicopter industry, the devastation this practice causes for everyone involved. While values which have been overly discounted may have somewhat less harmful effects, they still have a negative impact on true resale value for a particular model or a whole segment of the market, especially for models that are not frequently traded. They may also bring the wrath of the regulatory authorities with arguments of “bargain purchases” and the resulting tax implications.

Market perspectives will vary from one business to the next. An operator may have a different opinion than a private owner, who may have a different opinion than a lender or lessor. The appraiser exists to bring clarity to those varying perspectives by interpreting the value of the helicopter in relation to the market as it actually exists. Appraisers should come from a completely unbiased position, free from outside influences, using only facts, knowledge, and experience to develop an opinion of value. As a result, an appraiser will never be able to please every client’s value result expectations. Professional and ethical behavior is the only way the appraisal profession can maintain the public’s trust.

Appraisers and firms with inadequate qualifications or experience, or appraisers willing to purposely misrepresent values to satisfy the client’s specific needs tend to be more commonplace in a depressed market. It is important to make sure that you are not only employing a qualified and experienced appraiser, but one that maintains the highest standards. A reputable appraisal firm will not change their methodology and values to suit the needs of the client.

End users of an appraisal should take time to read the complete report. Note hypothetical conditions and assumptions, explanations of the methodology, definitions, and purpose used in the valuation process. Are all of these parameters appropriate for the situation and purpose? If the previous value results are available, compare them to the current value results. Significant value changes from one appraisal to the next may help identify potential issues. Watching for problem areas becomes even more important for lessors, lenders, and operators that require annual or bi-annual appraisals.

Differing appraisal methodologies, governing bodies, regulatory authorities, certifications and accreditations, U.S. Standards ( https://www.appraisalfoundation.org/ ) vs International Standards (https://www.ivsonline.org/), are all factors that influence how values are determined. Knowing your appraisal firm and its specialties is key to the accuracy of the values you will receive. While true market realities can be painful, knowing those realities, accepting them, preparing and dealing with them will not only ensure that the industry continues to have a healthy recovery, but it will help it recover faster, and avoid future negative effects of improperly and unethically performed appraisals.

About HeliValue$, Inc.

As pioneers of the helicopter appraisal process and methodology, HV$ has provided helicopter and parts appraisals for four decades. Our ASA accredited staff annually appraise over 2,500 helicopters. HV$ is the trusted advisor and industry-wide interpreter for an international clientele of manufacturers, vendors, helicopter operators, banks, leasing and insurance companies, and aviation law firms.

HV$ has also continually published The Official Helicopter Blue Book® since 1979. Information regarding specifications, current and historical resale values, current and historical manufacturer pricing, component overhaul and retirement intervals, and hourly maintenance costs are available for most of the 200 models covered in the Blue Book.

Future of the Offshore Heavy Market

Oil prices are slowly on the rise, but supply still remains higher than demand and values continue to decline. The face of the offshore heavy market has begun to shift.

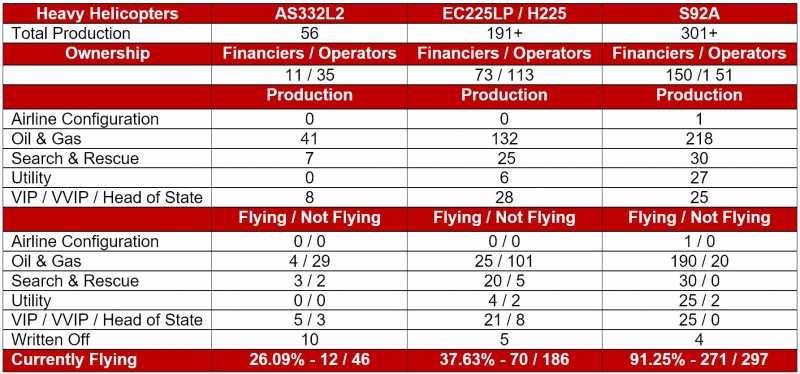

While there are many heavy class models in various roles, the predominantly offshore AS332L2, EC225LP/H225, and the S-92A have generated the most questions about the current state and future of the heavy class of helicopters. These aircraft have been impacted by multiple factors; a transition in the market from new purchase or resale to one largely influenced by the leasing sector, over purchasing of these aircraft by the lessors and operators during the boom of oil and gas, the slump in oil prices that has significantly decreased demand, and of course, the plight of the EC225 after its grounding and subsequent rejection by union oil workers.

Although the S92A has fulfilled many of the obligations created by the absence of the AS332L2 and EC225, there continues to be an excess of S92As which remain idle or in storage due to a lack of contracts. The chart below illustrates that there are 172 of these aircraft currently in abeyance. This number of aircraft would not be easily absorbed in today’s market or even in the long term.

Current Estimated Operational Breakdown

As a result of this oversupply, there has been a transition of these machines from their primary market into secondary markets. There has been some restored optimism for the EC225LP. The aircraft is finding renewed interest in the utility, para-public (search & rescue, law enforcement, firefighting), and military markets. Utility operators that hadn’t previously entertained using EC225 for their operations are now considering adding these aircraft to their fleet. It has been purported by some in the industry that activity for the EC225 will continue to increase as witnessed over the past six months. This is made evident by recent transactions and conjecture that there are several others pending. Additionally, there has been interest in converting the offshore S92A into a Search & Rescue role. Lessors have been acting on these interests and forming plans for placement of their aircraft. However, both aircraft are suffering from a shortage of parts to perform the necessary modifications. The unavailability of parts has resulted in extensive lead time for conversions to be completed.

Introduction of the Super Medium

The introduction of the 7/8-ton super medium class of helicopters poses a challenge to all heavy class helicopters. The super medium class of helicopters includes the Airbus EC175, Leonardo AW189, and the anticipated Bell 525 helicopter. These aircraft are capable of seating 16 to 18 passengers and perform the same work roles as those in the heavy class. It has been indicated by some that the super medium class of helicopters is capable of performing 90% to 95% of the offshore missions currently flown by heavy class helicopters.

Lessors have a large investment into the heavy class of helicopters, particularly the S92A. Based on current supply and lease rates, it can be more economical to lease an S92A over purchasing a new super medium. It is likely that leasing companies will offer and promote the heavies over the super mediums as the lower cost alternative. Ultimately, the demand of the operators and oil companies dictate the market. If operators/oil companies choose super mediums over the S92A, leasing companies would try to meet that demand and there would be an increase in the number of S92As on the resale market further impacting values. However, the S92A cannot be completely replaced by super medium class aircraft. The S92A would still have a significant market share of the offshore and search and rescue sectors.

Fleet Diversity

Some operators and oil companies have started to ask themselves if they may be too heavily dependent on a single model. Should a massive, long-term grounding like the EC225LP effect the S92A, the shortage would be devastating to operations. Diversifying a fleet with a mix of super mediums and S92As could lower some of the risks should such an event occur. The idea of diversifying a fleet is further spurred by sustained low oil prices which have caused long-range exploration to drastically decrease. Aircraft with a longer range will be in less demand until there is an increased need for long-range exploration.

Impact of Leasing

The helicopter industry has experienced a boom in leasing activity similar to the commercial airline industry, only over a much shorter period of time. Before the entry of the only dedicated helicopter lessor, Milestone in 2010, leasing activity was mostly between operators and on a much smaller scale. Presently, there are six major helicopter lessors with combined fleets of 600+ helicopters worth an estimated seven billion dollars, a large percentage of which are comprised of heavy class helicopters. Since a majority of heavy class helicopters are now owned by leasing companies, this means the lessors are essentially controlling the market for these assets. As lease rates drop to move idle inventory, leasing becomes an even more favorable option over buying a helicopter in today’s market. However, if lease rates continue to fall, asking prices and resale values will continue to decline and may not recover for many models.

Exact numbers of heavies currently for sale is difficult to determine. Based on publicly advertised listings, there are only four AS332L2s, fifteen EC225LP/H225s, and nine S92As. Many have chosen to place their aircraft with brokers as off-market listings, which means these numbers are conservative. Additionally, it is expected, over the next 12 to 16 months, an estimated 40-45 S92As will be coming to the end of their lease term. It is uncertain how many of those leases will be renewed. In response to the continued decline in the offshore heavy market, lessors have expanded their business to include light turbines. Lessor will likely put more focus in markets that are showing more stability and growth such as EMS, law enforcement, utility, and firefighting.

Today operating leases remain an attractive alternative to traditional financing for operators looking to retain cash, maintain balance-sheet flexibility, and align lease terms with contract terms. These benefits are all the more important under the current market conditions.

Outlook

The heavy offshore market continues to face many challenges, but the helicopter industry as a whole is resilient. It’s not certain how this market will evolve, but with time, it will adjust. What number of these offshore heavy aircraft find opportunities in different work roles, and what impact the new class of super mediums will have, will determine how that future is defined.

Oil Market Overview & Its Effects on the Sikorsky S-92A

I recently had a conversation with a marketing member of one OEM. We were in agreement that many of us did not see a continuation of low activity for this long. We asked ourselves, "What happened in the last 18 months to cause the continuing excess of heavy helicopter inventory?" Our past reasoning was that oil prices would return as demand would surely increase. In an article published in Forbes on August 28, 2016, Jude Clemente argues that world oil demand will continue to increase. It has steadily increased even through the 2008 recession. So what did we miss?

The Decline of OPECs Pricing Influence

America continues to be the largest consumer of petroleum products with the European Union close behind. China is third but has the fastest growing demand. The United States consumes about 19,400,000 barrels of oil daily, the EU is at about 18,000,000, and China is at about 12,000,000.Everyone else is far behind, but next is India at about 4,200,000. India has the second largest population in the world with an estimated 358,000,000 under the age of 15. Mr. Clemente says this is the biggest reason that India’s economy and thus petroleum product use will continue to rise rapidly in the coming years.

America continues to be the largest consumer of petroleum products with the European Union close behind. China is third but has the fastest growing demand. The United States consumes about 19,400,000 barrels of oil daily, the EU is at about 18,000,000, and China is at about 12,000,000.Everyone else is far behind, but next is India at about 4,200,000. India has the second largest population in the world with an estimated 358,000,000 under the age of 15. Mr. Clemente says this is the biggest reason that India’s economy and thus petroleum product use will continue to rise rapidly in the coming years.

In an article from Fuel Fix, a subsidiary publication of the Houston Chronicle, dated March 2016, Jennifer Hiller points out that the US dependence on foreign oil has declined dramatically. We import about 25% (this figure changes depending on definition and point of view), the lowest point since 1970. We were still importing over 50% until 2011. America’s demand for oil peaked in 2005 at a daily rate of 20,500,000 bbls. We are now using 19,000,000 bbls of oil daily. Most of the EU countries are showing the same trend of peaking some time ago and are now showing lower levels of daily demand. Regardless, that is still a considerable level of petroleum product usage.

In an article from Fuel Fix, a subsidiary publication of the Houston Chronicle, dated March 2016, Jennifer Hiller points out that the US dependence on foreign oil has declined dramatically. We import about 25% (this figure changes depending on definition and point of view), the lowest point since 1970. We were still importing over 50% until 2011. America’s demand for oil peaked in 2005 at a daily rate of 20,500,000 bbls. We are now using 19,000,000 bbls of oil daily. Most of the EU countries are showing the same trend of peaking some time ago and are now showing lower levels of daily demand. Regardless, that is still a considerable level of petroleum product usage.

There are 13 member nations now, and relations between the member nations are very shaky. Indonesia dropped out last year in disagreement with the “core” members. There are 117 countries producing oil today. Out of the top 25 oil producing countries, 16 are non-OPEC member nations.

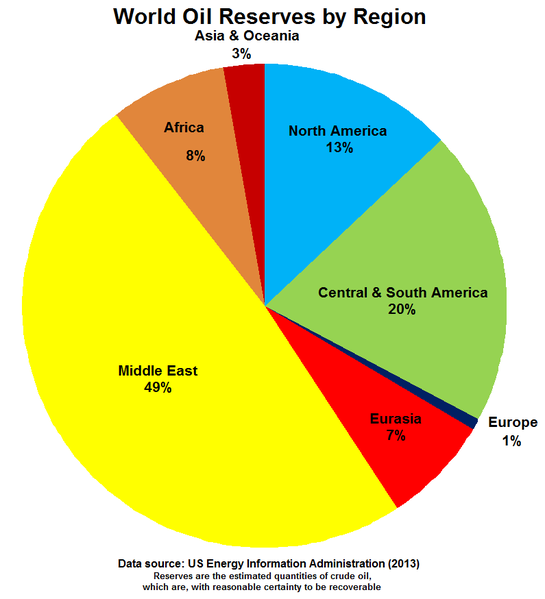

Where are the largest reserves today? Well, it depends on who is reporting the data and what definition of “proven reserves” is being used. There is no doubt that OPEC sits on a significant portion of the World’s oil. North America has surpassed Saudi Arabia, Russia, and Venezuela in estimated reserves. Estimates of China’s reserves seem to go up every year. Russia certainly has a significant amount of oil reserves. A majority of world reserves are now outside OPEC.

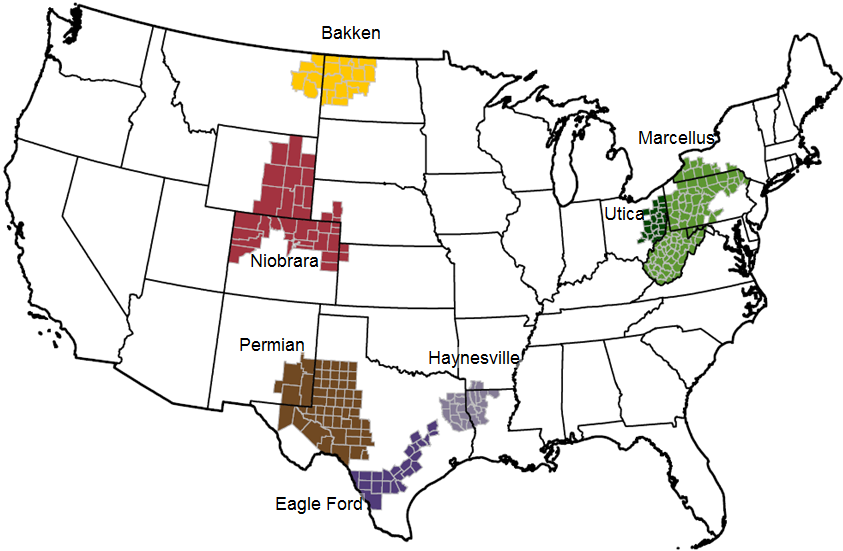

Exploitation of Shale Oil Reserves

The main reason that North America now has such large reserves is the viability of oil recovered by hydraulic fracturing. It was once thought that the price per barrel of oil had to be about $100 to make oil recovered by “fracking” economically viable. That was in 2011. The technology and techniques have improved every year. Oil prices had to be at $70 for fracking to be economical in 2014. In 2016 U.S. Energy Information Administration (EIA) commissioned HIS Global Inc. (HIS) to perform a study of upstream drilling and production costs. The report found that average well drilling and completion costs last year had fallen 25 to 30 percent below 2012 prices – the high point of the last decade.

The main reason that North America now has such large reserves is the viability of oil recovered by hydraulic fracturing. It was once thought that the price per barrel of oil had to be about $100 to make oil recovered by “fracking” economically viable. That was in 2011. The technology and techniques have improved every year. Oil prices had to be at $70 for fracking to be economical in 2014. In 2016 U.S. Energy Information Administration (EIA) commissioned HIS Global Inc. (HIS) to perform a study of upstream drilling and production costs. The report found that average well drilling and completion costs last year had fallen 25 to 30 percent below 2012 prices – the high point of the last decade.

It continues to get cheaper each year. For instance, when the price of oil got to $56 a barrel, many owners of fracked oil wells turned on the spigots, and US demand for imported crude oil dropped. The price for a barrel of crude dropped to $50 and has “recovered” to $51. Oil recovered from “fracking” is termed “tight oil.” Tight oil comes out of the ground cleaner meaning it is cheaper to refine into usable petroleum products than Brent Crude or May West Texas Crude (heretofore, the cleanest recovered oils). Despite the low price of oil, rig counts in the US are increasing.

The North Sea reserves are located far offshore and in deep water. Weather rapidly changes and can be very severe. It increases the cost to discover oil and then to recover oil. The Brazilian and Angola reserves are the next highest cost to recover because their reserves lay offshore under a sometimes two-kilometer thick “Presalt” layer. It is true that those costs have gone down as technology and techniques have improved, but any “deep water” exploration and recovery carries a higher cost than shallow water and land recovery oil wells.

The Effect on the Used Sikorsky S-92A Market

There were significant changes to helicopter values during our March 31, 2017, pricing meeting. The aircraft that had the most significant movement was the Sikorsky S-92 A. This is mostly due to the paucity of contracts in the North Sea. Obviously, the plunge in world oil prices in 2014 and the continuing low pricing per barrel of oil are the main reasons for the low helicopter activity. Another factor is the introduction of the “Super Medium” H175 and the AW189 in an already saturated market. The cost savings of leasing, buying, and operating the H175 or AW189 is giving them an edge compared over other heavies. There has also been an increased use of AW-139s where they can be employed over other aircraft. Regardless, any way you look at it, contract activity is very low and some available contracts are now requiring alternatives to the S-92A.

There were significant changes to helicopter values during our March 31, 2017, pricing meeting. The aircraft that had the most significant movement was the Sikorsky S-92 A. This is mostly due to the paucity of contracts in the North Sea. Obviously, the plunge in world oil prices in 2014 and the continuing low pricing per barrel of oil are the main reasons for the low helicopter activity. Another factor is the introduction of the “Super Medium” H175 and the AW189 in an already saturated market. The cost savings of leasing, buying, and operating the H175 or AW189 is giving them an edge compared over other heavies. There has also been an increased use of AW-139s where they can be employed over other aircraft. Regardless, any way you look at it, contract activity is very low and some available contracts are now requiring alternatives to the S-92A.

Because of the distance required to fly to any oil well, the S-92A is used almost exclusively in the North Sea, to a lesser extent the Brazilian Atlantic and the Gulf of Mexico. The older S-92A values are suffering from, well, age. Many of the new contracts in the North Sea will call for newer S-92As because of the requirements of oil companies and/or unions. Renewed production of the S-92A will face stiff competition because some of the contract renewals are asking for mediums and super mediums rather than the S-92A for cost savings. As a consequence, we see some used S-92A’s being returned to the banks at the end of their contracts. With virtually no secondary market for this aircraft, there has been little interest in what is coming onto the market. The trend of decreased values will likely continue until oil prices recover to a level that is profitable in the North Sea or the values of the S-92A reach a level that competes with the Super Mediums.

Oil prices may not have to recover as much as some fear to bring more activity to the North Sea. The big players (ExxonMobile, Shell, BP, Talisman, Hess) need a large profit margin to explore and operate. The smaller players, for example, Wintershall, Delek, and Chyrsaor, do not need a large exploration budget and they are willing to work on a smaller profit margin. They don’t look for oil. They exploit “spent” oil tracts. They don’t need the per barrel price for oil to be as high as the “large” oil companies. Wintershall’s Maria field was drilled the first time in the 1980s by Statoil. Wintershall acquired the rights recently and by combining pipelines and consolidating oil rigs, plan to continue to extract oil profitably. This is the possible future for “played out” oil fields throughout the North Sea. So, about $55-$60 a barrel could bring a return of some new contracts. The Maria field is about 200kms off the Norwegian Coast. Older helicopters would not be a problem as these operators need a tighter margin (read cheaper helicopter rates) to be profitable.

Technological advances will continue to drive down drilling cost on and offshore. As the world settles into the shift of sustained low ppb oil, the adaptive S-92A helicopter market will eventually find it's place in this new era.

About Ben Moore, ASA - Mr. Moore is a staff appraiser with HeliValue$, Inc. He specializes in helicopter parts inventories, legacy, Russian made, and military helicopters. He was a part-time onsite verification representative of HeliValue$, Inc. from 1984 to 2007. He developed the appraisal programs for inventories, the S64 “Aircrane”, the Russian helicopters MI-8 & KA-32-117, the UH-60 and the CH-47D. He is also a part-time Line Pilot in Command for Helicopter Transport Services, Inc.

As an Instructor Pilot, Mr. Moore has accumulated over 8,000 flight hours of instruction. He has given instruction to Vietnamese, Iranian, Ecuadorian, Peruvian and Canadian pilots in both flight and ground instruction. He has taught flight and ground training to Ecuadorian and Peruvian Pilots in Spanish. He teaches a full transition course for both the S-58 and the S-61 helicopters.

About HeliValue$, Inc. - Continuously published since 1979, The Official Helicopter Blue Book® is the only blue book in the world devoted entirely to helicopters. HeliValue$ is Most Trusted World Wide®in the helicopter industry for resale pricing, technical specifications, and maintenance costs. Their only business is helicopter values: the subscription sales of their publications, their desktop appraisals, onsite asset verification, technical and operational analyses, residual projections, and related reports concerning the values of more than 200 different commercial models and their components.

Evaluating a Report for USPAP Compliance

New Online Seminar!

Evaluating a Report for USPAP Compliance

A Special Offering for Lenders and Other Non-Appraisers

Lending professionals and other non-appraisers will gain a better understanding of the Uniform Standards of Professional Appraisal Practice (USPAP) and its applicability to the lending process through this online seminar created by The Appraisal Foundation in partnership with McKissock. The seminar provides insight about appraisers’ USPAP-related obligations in an assignment and arms the underwriter with knowledge of how to best evaluate an appraisal report for USPAP compliance.

This program is not intended for appraisers or to provide training for those performing appraisal review (as defined in USPAP) assignments.

Register for the seminar here.

Feel free to pass this along to your colleagues in the lending community!

Questions? Please contact Paula Seidel at [email protected].

Appraising the Appraiser

As originally appeared in Business Aviation Advisor, May/June 2015 (www.bizavadvisor.com)

Finding the Right Appraiser is as Easy as ASA

After the savings and loan crisis in the 1980s, and again in 2008, the banking industry responded with new rules and additional safeguards for better risk management.

One of the most significant changes involves aircraft appraisals.

Prior to 2008, a simple market evaluation by a resale broker, often with just a quick look at the current edition of the Aircraft Blue Book, was sufficient to secure as much as a 90% loan-to-value ratio for a preowned aircraft. That is no longer so.

Today, most banks, leasing companies, and insurance underwriters require that all loan collateral, including business jets, be valued by a qualified, certified appraiser before financing is approved. Those appraisers must comply with the Uniform Standards of Professional Appraisal Practice (USPAP), which was created in 1989 by the Appraisal Foundation, and is the generally accepted standard in Canada and Mexico as well as the U.S.

Two organizations provide such appraiser certification: the International Society of Transport Aircraft Trading (ISTAT), which focuses primarily on commercial airliners; and the American Society of Appraisers (ASA), which teaches, tests, and confers credentials to its members, who conduct professional appraisals for business and personal property valuation. The ASA's Machinery and Technical Specialties division offers the only program to train and certify business aircraft appraisers.

Appraisers earn that Aircraft Specialty accreditation by completing a rigorous curriculum and peer evaluation. ASA-accredited appraisers must adhere to the professional standards set forth by ASA's Code of Ethics and Principles of Appraisal Practice, and well as USPAP (in North America), or the International Valuation Standard elsewhere in the world. The two levels of ASA certification, Accredited Member and Accredited Senior Appraiser, are based on the number of years of appraisal experience, with continuing education courses required to hold either accreditation.

The recent rebound in business jet transaction activity has increased the demand for certified appraisals. To meet that need, two established aviation organizations, Jet Support Services, Inc. (JSSI) (www.jetsupport.com) and Embry-Riddle Aeronautical University (ERAU) (www.erau.edu) co-sponsored and co-hosted two ASA accreditation courses earlier this year, one at ERAU's campus in Daytona Beach, FL, and the other at JSSI's European headquarters in Farnborough, UK, with more courses planned for this fall.

What does this mean for you, the aircraft owner?

If you are interested in monitoring the value of your aircraft, whether for financing, refinancing, or sale; or to verify hull value for insurance coverage, you will need to have your aircraft appraised by an ASA-certified appraiser. This will ensure that you have the most accurate and lender-acceptable data.

On average, expect the appraisal to take about one week, with the physical inspection process usually one full day onsite, and the rest reviewing records. The appraiser will conduct a systematic inspection of the interior and the exterior of the aircraft, including: engine, airframe, avionics, instrumentation, and other systems; as well as provide a methodical review of your aircraft's flight and maintenance log books, FAA registration, title, and owner's documentation. Most business jet appraisers avoid "desktop only" appraisals because the inspection and review of the records is extremely important.

In 2015, the average cost for a full appraisal and inspection – required by most lenders – is about $5,000, perhaps up to $7,500, plus expenses. Be aware, however, that a standard appraisal is not the same as a pre-buy inspection for purchase, which can run between $10,000-$50,000 depending on the size and scope of the work.

Rules for lending have changed dramatically in the past six years. If you have not been in the market recently, know that a proper appraisal will ensure that you secure the right equipment at the right price, while meeting your lender's requirements.

For more information about and to find an accredited Appraiser go to www.appraisers.org or call 800-272-8258. BAA

Challenges of "Heavy" Overwater Helicopters

Mechanical failure, perception and confidence, and differing opinions about safety are all factors contributing to the successes and failures of rotorcraft. In this article, we will look at other models that have faced similar mechanical issues, some with distinctly different outcomes, and compare them to the current issues faced by the Eurocopter family of Super Pumas.

On November 5, 1986, a Boeing 234LR Chinook crashed near the Sumburgh Airport in Shetland Islands killing 43 passengers and 2 crew. The aircraft was grounded, and the resulting investigation by the Air Accidents Investigation Branch (AAIB) found the accident was caused by a failure of a bevel ring gear (gearbox) that allowed the two rotors to collide. Despite no prior history of mechanical accidents, clearance by the Civil Aviation Authority (CAA) and several test flights conducted by British International Helicopters, (who held a contract with Shell Oil Company at the time) the fears of the offshore workers could not be overcome. As a result, the oil industry sold off all remaining Chinooks which are now operated by Columbia Helicopters as non-passenger heavy-lift aircraft.

Another large offshore model, the Sikorsky S-92A, has also faced gearbox issues resulting in an emergency airworthiness directive that grounded all S-92As in 2009. Like the Chinook, these failures also resulted in catastrophic accidents. The fix for the S-92 gearbox caused controversy because it did not pass the 30 minute run-dry regulation required by the FAA, EASA, and Transport Canada Regulatory agencies. A provision of this regulation allows an exception for Category A transport helicopters; "The applicant must show that hazardous component effects are predicted to occur at a rate, not in excess of that defined as extremely remote". The FAA defines "extremely remote" as "Not anticipated to occur to each item during its total life, may occur a few times in the life of an entire system or fleet. Quantitative: Probability of occurrence per operational hour is less than one in ten billion flight hours." As of March 2013 the global fleet of S-92As has flown only 500,000 flight hours raising concerns about the application of this exception to this model. Despite the mechanical issues faced by the S-92 and concerns regarding the solution, the model continues to enjoy success, especially in the offshore transport market where 90% of the S-92As are being used.

Most recently, the Eurocopter Super Pumas have been plagued by gearbox issues. They also share similar safety fears from offshore workers, much like the Chinook 234LR, after two ditchings of the EC225 in the North Sea due to gear box failure. In fact, the initial grounding was not prompted by any civil aviation regulatory agency, but by the operators of the EC225. The further grounding by the UK and Norway aviation regulatory agencies resulted in Eurocopter trying to mitigate the impact to the operators by supplying them with gearboxes and other components to retrofit their (also effected) AS332 L1s and L2s to an older design, allowing this aircraft to be put back into service. On August 23, 2013, the crash of an AS332 caused offshore workers' to protest the continued use of the Super Pumas. Although no mechanical cause has been determined in the AS332 crash, it has raised serious concerns with the offshore workers. This is evidenced by the workers creation of a social media page protesting the continued use of Super Pumas.

Although an interim fix for the EC225 has been approved by civil aviation authorities of EASA, UK and Norway, operators have been slow to put the EC225 back into service. Currently the fix for the EC225 consists of two preventative measures; an ultrasonic non-destructive inspection (NDI) which must be performed every 8-10 flight hours, and the updated Health and Usage Monitoring Systems (HUMS) which now detects irregular vibrations in the gear shaft, allowing the pilot to safely land within two hours of detection.

The approval and implementation of these preventative measures has not allayed the fears of the workers. Can we look at the abandonment of the Chinook as an example of an issue Eurocopter might face with Super Pumas once the gearbox and the subsequent shaft cracking issues have been resolved? The ultimate solution to the problem is a redesign of the gear shaft which could take more than a year to complete. Will the extended final fix time cause confidence concerns resulting in reduced operations of Super Pumas as offshore transport or does the current demand for the S-92A and other large offshore helicopters imply more trust in the civil aviation authorities' judgment and forgiveness of past mechanical failure? Will Super Pumas make a successful return like the S-92A? It seems the question is still up in the air.

Your Accountant Says You Need a “Qualified Appraisal”. Where Do You Start?

Your company is being audited. You’re purchasing a company and need to allocate the purchase price across the assets. You’re getting divorced, or married, or your spouse passed away. You bought a helicopter. You sold a helicopter. You donated a helicopter to a museum.

Whatever the reason, you have a transaction that needs to be reported to the IRS.

The IRS has defined criteria for a qualified appraisal and a qualified appraiser. A “qualified appraisal” is one performed by a “qualified appraiser” in accordance with generally accepted appraisal standards.

In the US, Canada, Australia, Japan, and several other countries, those “accepted standards” are the Uniform Standards of Professional Appraisal Practice (USPAP). In most other countries they are the International Valuation Standards (IVS) or the RICS Red Book. This is your first checkpoint – if your appraiser doesn’t comply with the standards, look for another appraiser.

Your second checkpoint is discovering whether your appraiser is qualified.

A “qualified appraiser” has either earned an appraisal designation from a recognized professional organization, or has similar education and experience, in the type of property subject to the appraisal. S/he must “regularly” perform appraisals for hire. And s/he may not have been prohibited from practicing over the past 3 years.

A helicopter is defined as a piece of personal property in the specialty of “machinery and equipment.” There are very few recognized professional appraiser organizations covering machinery and equipment: American Society of Appraisers (ASA), Association of Machinery and Equipment Appraisers (AMEA), and Royal Institution of Chartered Surveyors (RICS) come to mind.

Of these organizations, two have at least one helicopter appraiser: ASA and RICS. Both meet the minimum education and experience requirements of the IRS. Appraisers accredited by either organization have passed multiple courses in appraisal principles, the accepted standards of their organization, ethics examinations, peer reviews of their appraisal reports or case studies, and have at least five years of appraisal experience. Both organizations have mandatory Continuing Professional Education requirements. The ASA further has a specialty designation just for aircraft (yet another test to be passed before accreditation.)

The appraisers and analysts at HeliValue$, Inc., are all either accredited by the ASA or are in training for their accreditation. We have two Accredited Senior Appraisers, one Accredited Member (who is very near advancement to Senior status), and two Analysts still in coursework.

Sharon Desfor, ASA, MRICS, is president of HeliValue$, Inc., the world’s most trusted helicopter appraisal firm, and publisher of The Official Helicopter Blue Book®, the accepted standard for helicopter resale pricing information. Sharon is an Accredited Senior Appraiser of the American Society of Appraisers (ASA) and a Member of the Royal Institution of Chartered Surveyors. She currently serves on the ASA’s Board of Governors. Sharon is past Chair both of the Helicopter Foundation International and of the Finance & Leasing Committee of the HAI. You can find her profile at www.linkedin.com/in/sharondesfor.

Oops, My Registration has Expired?

HeliValue$’ president, Sharon Desfor, is a member of HAI’s Finance and Leasing Committee, whose last meeting spent considerable time discussing the new problem of expired FAA registrations. The research shows over 31,000 aircraft on the FAA registry with expired registrations / pending cancellations. Over 6,200 aircraft, some 300 of them helicopters, have already-cancelled registrations. If any of those aircraft is in active use, it is illegal to fly them until they have been re-registered. Every single flight on a cancelled registration carries a $10,000 fine. And that’s the point. Under previous rules, aircraft registrations did not expire, and over the years, paperwork had not kept up with ownership transfers, so that the FAA no longer knew with any certainty who owned which aircraft.

As far as lenders and lessors are concerned, the important news is that aircraft security interests may be affected. Owners, operators, and financiers should implement procedures to assure that the aircraft is registered and re-registered on a timely basis. Although security interests on aircraft covered by International Registry (Cape Town) registrations are expected to remain perfected, non-Cape Town equipment is not specifically addressed. Certainly UCC filings should still be filed to protect security interests.

More information about the re-registration process, including a calendar for determining when your paperwork is due, is available on the FAA website. The list of expired registrations is available at http://registry.faa.gov/AircraftRenewal_reports/PendingCancel_Results.aspx?Sort_Option=1&Sort_Direction=1&PageNo=1,and cancelled N-numbers are listed on http://registry.faa.gov/AircraftRenewal_reports/CanceledReg_Results.aspx?Sort_Option=1&Sort_Direction=1&PageNo=1

More information about the re-registration process, including a calendar for determining when your paperwork is due, is available on the FAA website. The list of expired registrations is available at http://registry.faa.gov/AircraftRenewal_reports/PendingCancel_Results.aspx?Sort_Option=1&Sort_Direction=1&PageNo=1,and cancelled N-numbers are listed on http://registry.faa.gov/AircraftRenewal_reports/CanceledReg_Results.aspx?Sort_Option=1&Sort_Direction=1&PageNo=1

The recent HAI RotorNews alert on this topic can be found at http://www.rotor.com/Publications/RotorNewssupregsup.aspx.

Critical Elements of Helicopter Value - Part 2 of 2

In Part 1 we defined micro elements are those which are inherent in the helicopter itself. Let's then define macro elements as those which are external to the helicopter and are imposed by the general economy: supply and demand, industry growth or contraction, client growth or contraction, availability of capital, and force majeure.

Macro Elements of Value

Supply and demand

This is an easy concept that we all use every day. In spite of the P/Q/E Marshall graphs you studied in Economics 101, most of us think in simplified terms that work well enough for this topic: More demand and less supply = higher prices; less demand and more supply = lower prices.

From 2004-2008, the helicopter industry enjoyed its own value bubble. With the advent of abundant capital, helicopter operators were able to finally begin fleet replenishment – replacing 10-20 year old machines with newer, more modern aircraft. The ability to get easy financing let to a sort of hysteria in the market, with orders for new helicopters doubling and then tripling in the space of just a few years. This in turn led to speculators placing orders, and then selling their "positions" or serial numbers, at or before their scheduled delivery date. When no positions were available and manufacturer backlogs for popular models exceeded two years, operators began paying increasingly higher prices for used helicopters of the same model. By mid-2008, the extremely popular Bell 407, for instance, cost US $2.4MM from the factory, with a 3-year delivery wait – or $2.7MM off the street with fully half of its component hours used, but available for delivery immediately.

In the last half of 2008, the price of crude oil fell from $130 bbl to nearly $30 bbl. Oil companies reduced their production, which reduced the number of helicopters needed to fly to the rigs. The flow of helicopters entering the resale market increased almost daily, and where once an operator had to knock on doors with cash in hand to find a viable Bell 407 to fulfill a contract, today there are more than 60 of them available with asking prices starting at $1.5MM and with average marketing periods of up to a year.

The economic principle of supply and demand differs from, but is closely related to, the economic principle of substitution which states that a prudent buyer will pay no more for an asset than it would cost to replace it with an equivalent property. So if you need a Bell 407 today, and one is available on the market for $2MM, you would not pay $2.5MM for an equivalent 407 (one with the same component status and equipment).

Industry and client growth and contraction

Popular uses for helicopters include offshore oil support, emergency medical transport, Electronic News Gathering, firefighting, construction, logging, aerial patrol, executive transport, mining, seismic survey and support, sightseeing, fish spotting, ranching, and agricultural spraying. These markets all play a role in determining marketability and therefore value as well.

By far the largest driver of the helicopter market is offshore oil support. While not on a par with jets or business aircraft, the offshore operators fly far more than any other helicopter operators. For example, in the Gulf of Mexico, in an area only 125,000 square miles, there are almost 500 helicopters, supporting over 5000 platforms, and making 2572 trips per day. This comprises almost a million flights per year, carrying 2.33 million passengers per year in 334,000 flight hours. The North Sea, Brazil, and several other oil fields require even more helicopter operations. The typical offshore helicopter flies 1200 hours per year. When you consider that each helicopter requires from 1 to more than 5 hours of maintenance for each hour of flight time, that's an extraordinary effort.

The oil industry is stretching farther and farther, to big rigs 150 miles offshore. To make these trips, helicopter operators are buying ever-larger helicopters with long-range fuel reserves, sophisticated electronic cockpits, and large payloads. These operators are moving away from short-range machines costing one to five million dollars that can carry 6-10 people, and into heavy twins that cost up to twenty-five million dollars and can carry up to 20 passengers. In spite of the viability of this market and the upward trend in oil prices, contracts for crew transport have not been increasing as quickly as hoped, leading to the placement of yet more helicopters into the resale market.

Another significant market is Emergency Medical Services. The EMS sector alone uses over a thousand helicopters ranging from million dollar single-turbine machines that barely fit a single stretcher up to sixteen-million-dollar medium twins that can carry several patients at a time, or can instead be fit with a flying emergency room. This end of the market is undergoing constant mergers and acquisitions, leading to consolidation in the hands of very few operators.

A new, rapidly growing segment is Search and Rescue. SAR contracts are typically for ten- to thirty-million-dollar medium- to heavy twins with enough power to lift a great deal of sophisticated mission equipment including glass cockpits, icing conditions equipment, life rafts, Doppler auto-hover, rescue hoists and winches, emergency flotation gear, rappelling devices, and crews of 5 or more. "Rapidly-growing", however, refers to dozens, not hundreds or thousands, of SAR helicopters in the world at this time.

Availability of capital

In 2008 the liquidity crisis first hit aircraft financiers. Changing bank and government regulations, risk level definitions, and capitalization requirements decreased the available money supply, borrower delinquencies, defaults, and bankruptcies increased dramatically in the two years leading up to the liquidity crisis. Helicopter industry consolidation led to lenders' and lessors' portfolios becoming increasingly concentrated, leading to loan refusals simply because the customers had exceeded their allowable portfolio credit limits. Equipment finance company consolidations have led to a vanishingly small number of financiers who fund helicopters. On the bright side, private equity and investment funds have entered the helicopter finance market, allowing transactions to proceed while the finance industry resets itself into new configurations for the new economic and regulatory realities.

Force majeur

The impact of force majeur on helicopter operations, and therefore helicopter values, cannot be predicted, but can be considerable. As an example, look at the Gulf of Mexico's Deepwater Horizon explosion in April 2010. By the end of May there was a U.S. moratorium on deepwater oil drilling. Gulf-area helicopter operators claimed a loss of contracts due to the moratorium, although Bristow Group was the only offshore helicopter operator to publicly release hard data. By June 11, nine of their helicopters had been affected by the ban, seven of which were released by their customers for the duration of the moratorium. These seven helicopters had been generating $3.8 million per month for Bristow. It is reasonable to believe that the other major Gulf operators saw a similar impact.

Conclusion

A helicopter is a fascinating, quirky asset. Although it bears much commonality with airplanes, it has several different properties. The more utilitarian viewpoint of its buyers makes it less vulnerable to wear-and-tear deductions from the value. The vast number of components, each with a separate maintenance schedule, makes careful, line-by-line component analysis a requirement. The different market sectors, utilizing their individual requirements to determine their "ideal" helicopter, combine with the pressure-cooker of today's low demand and high supply to create a complex web of betterments and detriments to a helicopter's value. And the maze of federal codes and agencies, regulations and treaties, insists upon a deeper-than-skin-layer analysis of consequences of potential acquisitions and potential uses in a variety of different countries and cultures.

Understanding the helicopter and its resale market, its function in the world and the needs of its operators, and the needs and requirements of the lenders and lessors who bring life to this small industry, are all critical aspects to a viable determination of this terrific little machine's value.

Critical Elements of Helicopter Value - Part 1 of 2

Are you thinking about buying a helicopter? Selling one? Funding a purchase or lease? As in economics, there are both micro and macro elements critical to its value.

Let's define micro elements as those which are inherent in the helicopter itself. These are the things that a buyer looks for: the status of the components as a percentage used, the existence of power-by-the-hour contracts on the engine(s) or drivetrain, the configuration and installed equipment, the avionics, the country of registry, and the quality of the operator who has been using it.

Micro Elements of Value

Component status

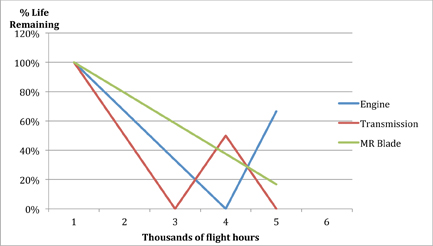

Arguably the most famous definition of a helicopter is "an assembly of forty thousand loose pieces, flying more or less in formation." Given a specific helicopter, the most important micro element of value is the components' Time Since Overhaul (TSO) or Time Since New (TSN). This includes the dynamic components such as engines, transmissions, swashplate, main- and tail-rotor blades, drive shafts, and flight controls; and we'll throw in the major airframe inspection as well. "TSO" is used for components which must be periodically overhauled and then returned to service. "TSN" is used for components which must be removed and replaced with new or serviceable components at specific intervals. The second are often called "life-limited" components and the first "rotables."

Most serial-numbered components are given a finite amount of flight time before they must be removed. The percentage of flight time used is the primary determinant of a helicopter's value relative to the resale market. More flight time used = lower value; less flight time used = higher value. However, when these parts time-expire, they can be replaced or overhauled, which raises the helicopter's value by approximately the cost of the overhaul or of the replacement part.

As you can see from the chart above, not every component depreciates over the same amount of flight time. A series of formals is used to determine the average of all the components' percentages used at any point during its life, allowing the helicopter to be accurately measured against comparable sales, offerings, and pending contracts.

Component times are determined by examining the helicopter's flight and maintenance logbooks. The logbooks record every minute of flight time, every component change, every overhaul and inspection related to that particular airframe or engine. Additionally, every serial-numbered component has a hard card (the flight and maintenance records for each individual component) that follows it throughout its life, from birth to death, regardless of what helicopter the component is installed in at any given moment. Components move frequently from inventory to airframe, and from one airframe to another. It's faster to remove a component and replace it with a fresh one than to take a helicopter out of service while waiting weeks for an inspection or overhaul. This is as true of a small component such as a hydraulic servo as it is of a large one such as an engine. With so many component changes occurring at any time during a helicopter's operation, individual records are required for every component as well as for the helicopter itself. (These required records are absolutely critical to the operation of a helicopter and its resale value. Any FAA inspector can shut down the helicopter at any time if he requests a record that does not exist or is inaccurate. Questionable records could do more than shut down the helicopter, they could shut down an entire operation. Clean, detailed, accurate records are a point in favor of a helicopter at its time of resale, regardless of your role as buyer, seller, or financier.)

Power-by-the-Hour

A Power by the Hour (PBH) contract is essentially a prepaid maintenance agreement in which the operator sends the manufacturer a fixed hourly payment and the manufacturer provides a freshly overhauled replacement part for every component under the contract term that comes to its life limit (or fails). The PBH-covered parts and components are therefore considered to always be guaranteed to be either actually in, or to be qualified for restoration to, a "zero" or "low" time service life condition. They each retain a high dollar value, regardless of their actual service life status, by virtue of remaining in "like new" condition as a result of the paid-up PBH program. Because PBH includes scheduled maintenance, it is far more than an insurance contract, and carries far more weight when valuing the helicopter.

Configuration and installed equipment

Installed equipment and avionics values are unique to each helicopter. Those items that translate well across multiple usages like air ambulance, offshore oil support, and personal use, or those that improve the performance of the helicopter, are those that supplement the helicopter's value the most. Three examples: 1) the Carson Helicopters composite main rotor blades for the Sikorsky S-61 can increase the value of the helicopter by more than the cost of the blades. 2) The Garmin 430 GPS is the most popular navigation aid in a helicopter's cockpit across all models and all usages, and correspondingly adds more value than smaller or less popular models, and an equal amount to larger, more expensive units. 3) A Restricted Category certificate of registration will reduce the value of the helicopter except in very specialized models and usages.

Country of registry

A financier will want to know the country in which the operator will be operating. Some countries carry inherently higher risk, such as those which have been known to exercise eminent domain under questionable circumstances on assets with liens perfected by someone else. Higher risk causes the financier to charge accordingly higher rates. Countries which are signatories to the Cape Town Convention (properly known as The Convention on International Interests in Mobile Equipment and Aircraft Protocol) offer the lender better remedies for default conditions, among other improvements in perfecting their interests.

Quality of previous operator

Buyers and financiers alike want to know the quality of the previous operator before investing in a helicopter. Their predominant interest obviously lies in the maintenance of the helicopter, since that directly impacts the helicopter's value in terms of the status of the components' TSOs and TSNs. Because of the chain of liability, buyers and sellers will also want to know whether there are any pending or contingent charges, liens, or litigation against the previous owner and/or operator.

End of Part 1

Login

Login